Real Life Careers: Actuary

Careers

This article is the fifth in a series on ‘Real Life Careers’ in which we chat to people about their career and look at the (sometimes unexpected) paths they took to get there. Nic Smit (30) is currently a Product Actuary, and he kindly answered our questions about how he got where he is. Nic is a qualified actuary (FASSA – Fellow of the Actuarial Society of South Africa). Separate to that, he holds a Postgraduate Diploma in Financial Planning.

High school

We asked Nic some questions focusing on his experiences in high school and how they may have impacted his study and career choices.

Q: What subjects did you take at school?

A: Maths, Science, Technical Drawing, Accounting, English, Afrikaans and AdMaths (now AP Maths)

Q: What were your favourite subjects at school?

A: Definitely maths and the physics side of science (I didn’t love chemistry) because they were black and white, logical subjects. I wasn’t a fan of English for the opposite reason – I felt it was too subjective.

Q: Would you say any of your favourite subjects have been helpful to your Degree/current career?

A: In my line of work being able to think logically is crucial, so yes maths was vital. However, it’s more the skill of thinking logically that has proved useful at work – I haven’t used trigonometry or geometry at all since leaving high school. Being able to think logically and apply what you know to a problem is a skill you need to have in an actuarial career.

In my line of work being able to think logically is crucial.

Q: What skills that you learned at school have proved helpful?

A: Even though I didn’t love English in school I have recently realised that it was an incredibly important subject. You need to be able to communicate properly and you need to be able to motivate why your approach to a problem is the correct one. Only English teaches you this in school.

You need to be able to communicate properly and you need to be able to motivate why your approach to a problem is the correct one. Only English teaches you this in school.

I was also a bit of a know-it-all as a child and going to an all-boys high school taught me that that kind of behaviour doesn’t endear you to most people. I’ve learned that if you want to get people to buy into what you’re trying to achieve, emotional intelligence (EQ) is much more likely to get people to work with you than IQ.

I did toastmasters and public speaking in grade 11 to get over my chronic fear of talking in front of people, and that was probably the most important choice I made in high school. You need to be able to stand in front of people and present ideas.

I did toastmasters and public speaking in grade 11 to get over my chronic fear of talking in front of people, and that was probably the most important choice I made in high school. You need to be able to stand in front of people and present ideas.

Q: What do you wish you had done more of while at school?

A: I wish I had done debating from grade 8. I think that would have helped me more in being able to formulate an argument and motivate for a particular solution.

I also wished I had taken computer science. I feel everyone should be learning how to program. I am learning as an adult, but it would have been great to learn those skills while in school.

I feel everyone should be learning how to program.

Q: Were you aware of your current career when you were in high school?

In grade 11 I knew what I wanted to do. People would say that if you loved maths and wanted to earn a decent salary, you should become an actuary. I chose my career on that basis, and in retrospect it was for completely incorrect reasons. I am incredibly lucky that I enjoy the work I do now, but for completely different reasons.

University

Nic takes us through the academic pathway that one must take to be an Actuary.

Q: Did you take a gap year, and why?

A: No. I was too impatient to start working and didn’t want to delay my career by a year. In retrospect, a gap year wouldn’t have been the worst thing in the world, but you need to have something purposeful to do every day.

Q: Did you get into your first choice Degree and institution?

A: Yes – I did a BSc in Statistics and Actuarial Science at UKZN. After that, I did the Actuarial Science conversion course at UCT.

Q: Did you start tertiary education pursuing the degree you ended with?

A: Yes. I started my degree in 2005 and finished in 2007. I did the course at UCT in 2008.

Q: What attracted you to pursue the Degree and career you did/are?

A: Like I said, I wanted to be an actuary because I liked maths in school and that’s what everyone said you should do.

Q: Is your current career path related to your Degree?

A: A lot of the basic skills you learn are crucial in an actuarial career (like financial and actuarial maths, finance, economics, statistics). However, there are many subjects I learned in my degree that I don’t use at all anymore (the heavy statistical theory, for example)

Q: Have you done Postgraduate studies and would you do so again if you went back to the end of undergrad?

A: Yes. You need to study after your degree in order to qualify as an actuary – so absolutely, yes.

Career: Actuarial Scientist

In this section, Nic details what is required when one has qualified as an actuary and starts working in the field (particularly in Durban). He also reflects on things he has learned in his journey.

Q: Do you have a specific focus or speciality within your field?

A: While I am an actuary, my primary focus has been in developing insurance products

Q: Why did you choose this speciality?

A: Out of necessity really – there aren’t many actuarial jobs in Durban where I work and the company I work for (FMI) needed a product actuary. However, now that I’ve fallen into it I quite enjoy it.

Q: What does your job entail day to day?

A: It varies, depending on the time of year, but the main duties I have are:

- Product development: I work with the different departments to develop the best possible product. Different departments want different things. Your Sales department wants a product that is better and cheaper than everyone else’s. Your Claims Department will want watertight terms and conditions. The management wants a profitable product. Often these different areas pull you in different directions and you have to judge where you peg your final offering.

- Pricing: Setting the premiums we charge is probably the most typical actuarial function I perform.

- Implementation: Once you have developed a product, you need to get the whole company to work with it. This requires you to make sure IT code the product correctly, your Marketing department develop documentation that is accurate and can push the strengths of the product, your sales team needs to be able to train your customers on the product, the Claims department knows how to assess claims etc. A fair amount of my time is spent making sure everyone knows how the product affects them.

Q: What ‘things’ would you recommend individuals who are wanting to go into your field to consider that they may not be aware of?

A: Speak to an actuary and try to do your work experience at a place that does actuarial work. If you just love maths, there are careers that are a better match for you than actuarial science, in my humble opinion. I have grown to enjoy the work that I do, but if I had just wanted to do maths all day I don’t think I would have enjoyed my career as much as some of the other available careers.

This article was originally published on 07 Dec 2016

About the author

Jax Heilgendorff

I have watched the development of AL.com for years and marveled at the ingenuity and passion shown from the start. As a Linguistics major, university lecturer and burgeoning copywriter, the Advantage Learn story is one close to my heart. I hope to add to the development of educational thinking in South Africa by helping to relate topics and create spaces for thought on the challenges and opportunities facing South African learners, students, and parents.

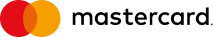

How to book your NBT test: a step-by-step guide

NBT

Featured

Booking your National Benchmark Test (NBT) is a crucial step in your journey towards university admission in South Africa. Here’s a detailed guid... Read more

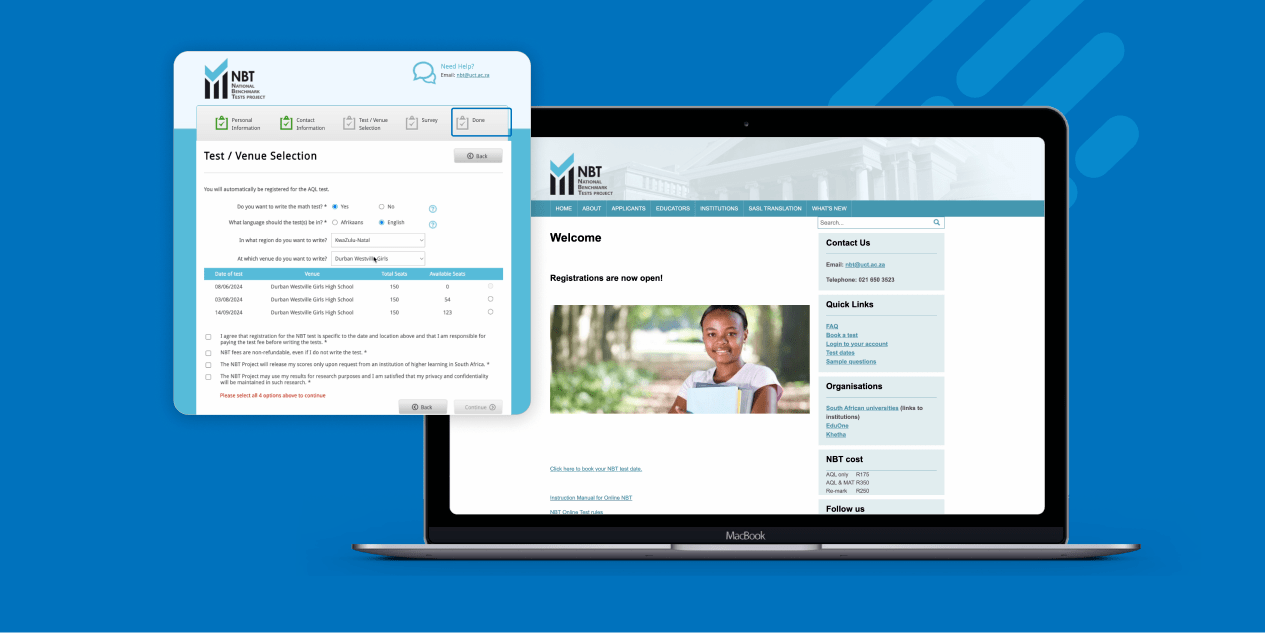

Resource Drop: Grade 8-12 Maths Question Banks

Maths

Education

Neo Series

Featured

As educators ourselves, we understand the myriad of challenges faced when curating materials for effective teaching and assessment. It’s a balancing ... Read more

Class of 2023 Further Studies Results

Further Studies

Thriving on a challenge The Independent Examination Board (IEB) released the results of their International Secondary Certificate (ISC) on the... Read more

Do you want better Maths results?

Maths Online is a bank of over 2000+ extra lessons. Furthermore, gain access to our teacher support to help you when you need it!

More info